per capita tax in pa

Steelton Borough Steelton-Highspire School District Paint Borough Delinquent Per Capita only Scalp Level Borough Delinquent Per Capita only Windber. The address is City Treasurers Office 449 West Main Street Monongahela PA 15063.

Per Capita Tax Eliminated In Perk Valley Sd Perkiomen Valley Pa Patch

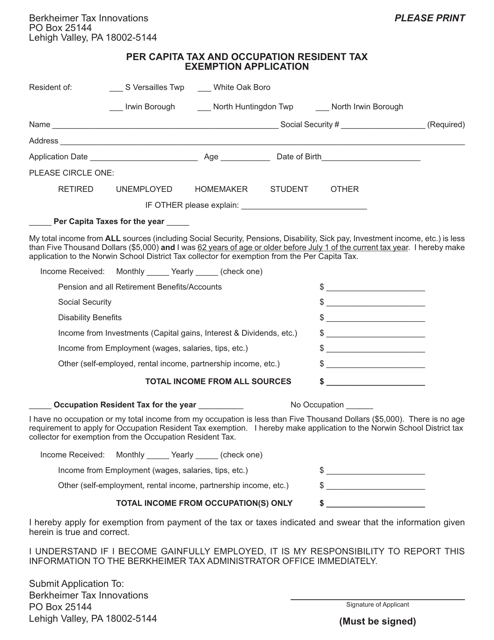

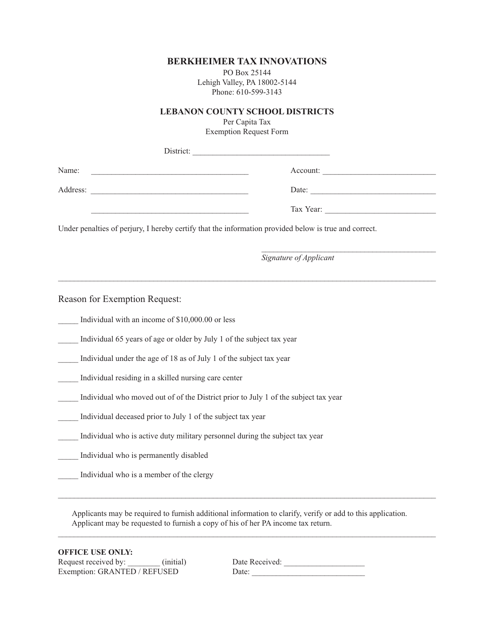

B Each local taxing authority may by ordinance or resolution exempt any person whose total income from all sources is less than twelve thousand dollars 12000 per annum from the per.

. What is the Per Capita tax. City of Reading. If your income changes you move out of Antis Township or you have any questions about the Per Capita Tax please call Susan E.

Per capita is a tax collected for each adult individual 18 years and older within Arnolds taxing district. Per Capita Tax We collect for. The Per Capita Tax rate is 1000 ten dollars.

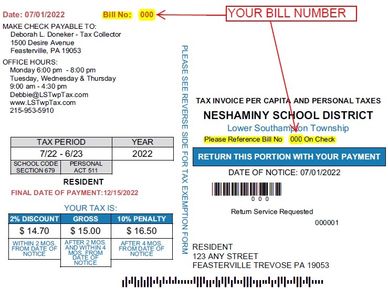

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Section 6-679 - Per capita taxes. If you pay your bill on or before the discount date in September you receive a 3.

For most areas adult is defined as 18 years. Motor and Alternative Fuel Taxes. What is the Per Capita tax.

All Adams County residents eighteen years of age or older. Reminder to pay your Per Capita tax bill before December 31st. Per Capita taxes are assessed by the Municipality and the Franklin Regional School District on all residents who have attained the age of twenty-one 21.

Per Capita means by head so this tax is commonly called a head tax. Per Capita means by the head so it is a tax commonly called a head tax. Current Year Taxes may be paid in either the Discount Face or Penalty period.

County Per Capita Taxes are based on a calendar year from January 1 thru December 31 of the current year. Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. It can be levied by a municipality.

Sales Use and Hotel Occupancy Tax. Exoneration from tax is applicable to the current tax year only. The list must also include persons who are retired unemployed or persons not currently working.

For most areas adult is defined as 18 years. What is difference between an ACT 511 and ACT 679 Per Capita Tax. PER CAPITA TAX INFORMATION.

Business Privilege Tax A flat. For most areas adult is defined as 18 years of age and older. ACT 511 Tax is a Per Capita Tax that can be levied at a maximum rate of 1000.

The Per Capita Tax bill is sent in July. The collective name for mercantile and business privilege taxes which are essentially the same tax levied on the privilege of doing business within a jurisdiction. The application form may be used by a PA taxpayer whose community has adopted one or more tax exemptions.

Municipalities and school districts were given the right to collect a 1000. Each resident or inhabitant over eighteen years of age in every school district of the second third and fourth class which. Per Capita Tax is a tax levied by a taxing authority to everyone over 17 years of age residing in their jurisdiction.

The Per Capita Tax is a flat rate local tax payable by all adult residents living within a taxing jurisdiction. Are listed on the per capita per. Face is the actual tax due which is the sum of any combination of Per Capita Act 511 Tax Per Capita Act 679.

If you own your own home the Per Capita Tax is added. This tax is due yearly and is based solely on residency it is NOT dependent upon employment or property ownership.

Attention Earl Township Earl Township Berks County Pa Facebook

Monroe County Residents Struggle Under Pa S Highest School Property Taxes

Real Estate Tax Antis Township Blair County Pennsylvania

Pennsylvania Per Capita Tax And Occupation Resident Tax Exemption Application Norwin School District Download Printable Pdf Templateroller

Pennsylvania Per Capita Tax Exemption Request Form Lebanon County School Districts Download Printable Pdf Templateroller

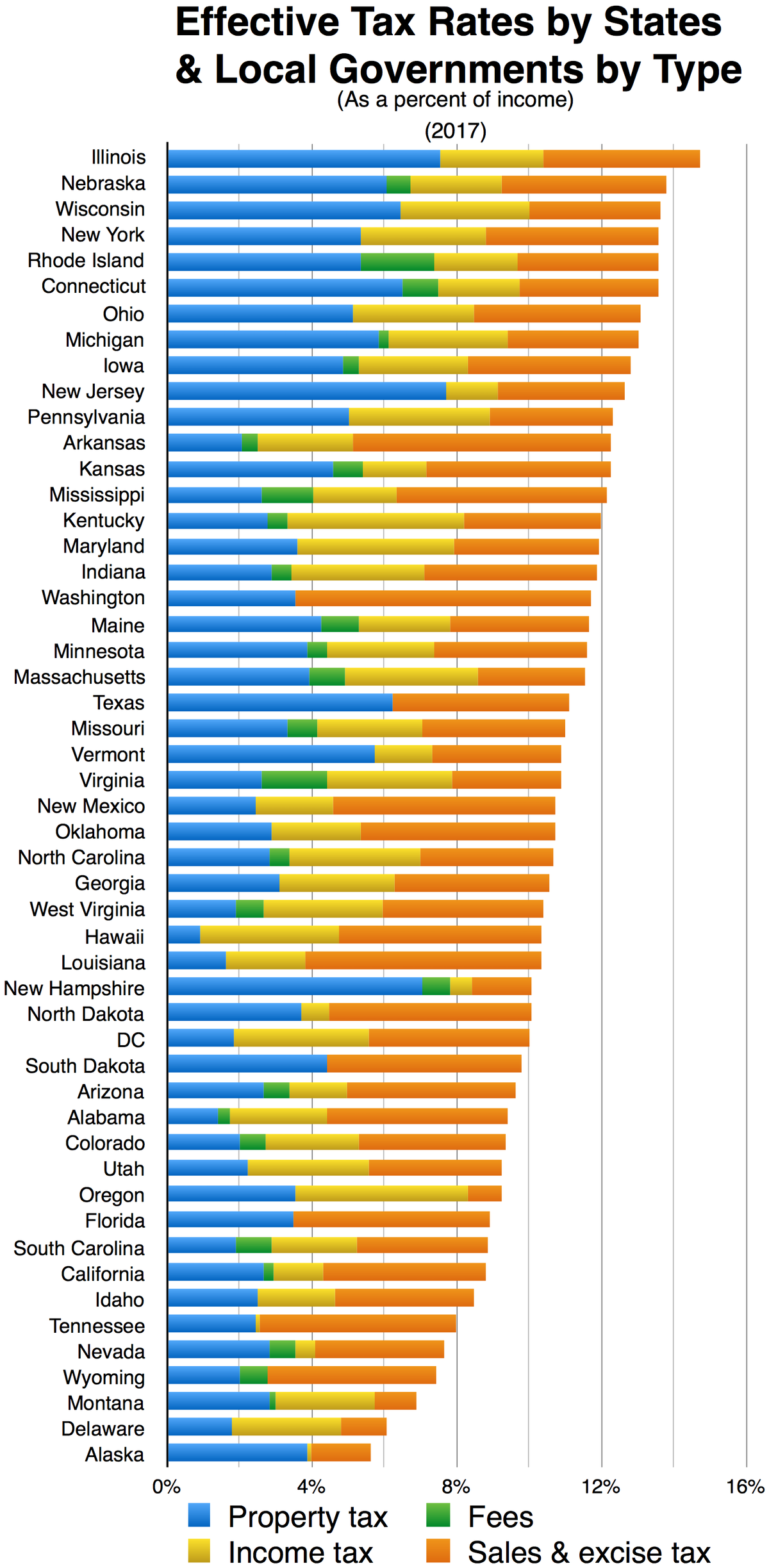

File State And Local Taxes Per Capita By Type Png Wikipedia

List Of Pennsylvania Counties By Per Capita Income Wikipedia

Balance Of Payments Portal Rockefeller Institute Of Government

Tax Claim Indiana County Pennsylvania

State Local Tax Burden Rankings Tax Foundation

How High Are State And Local Tax Collections In Your State

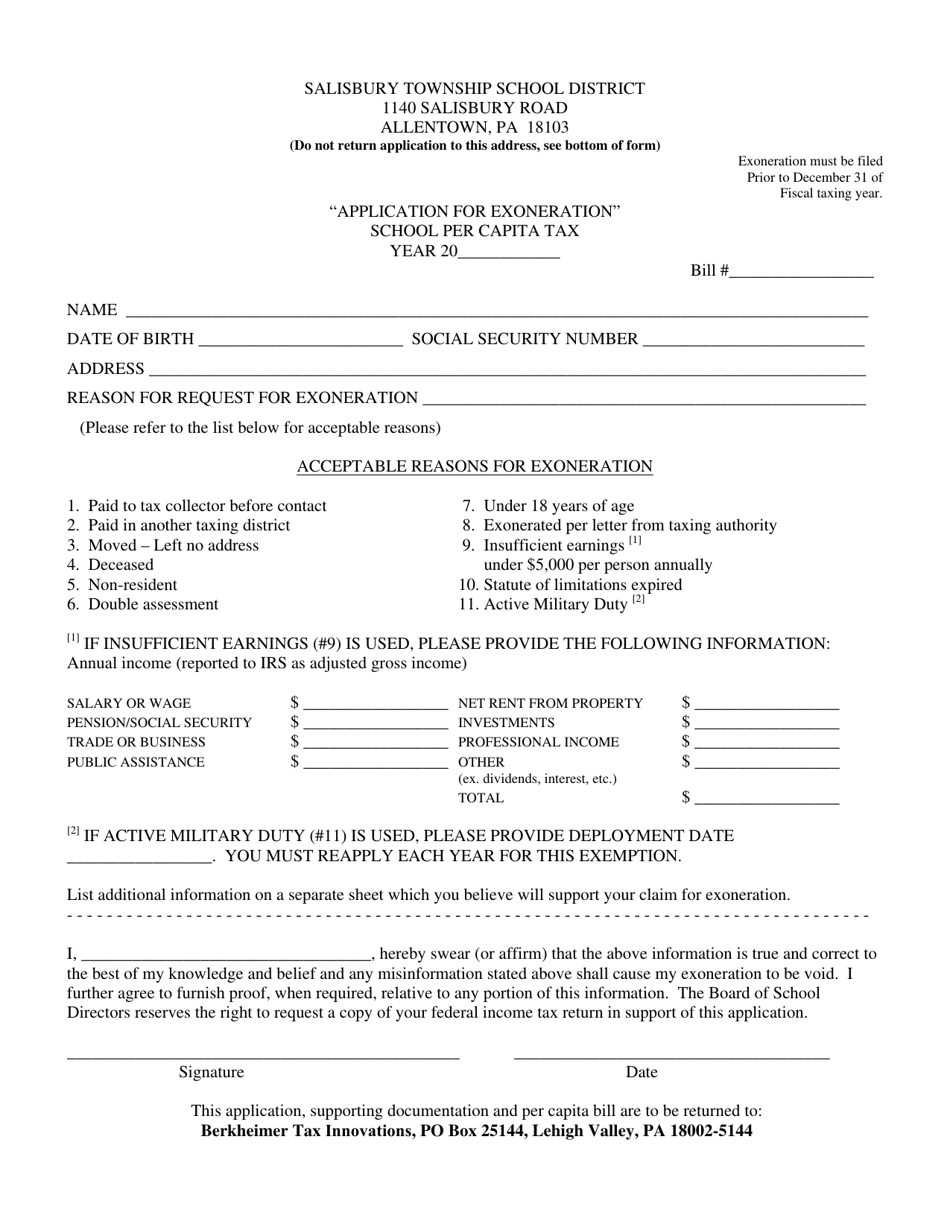

Pennsylvania Application For Exoneration School Per Capita Tax Salisbury Township School District Download Printable Pdf Templateroller

State Sales Tax Collections Per Capita Tax Foundation

Attention Earl Township Earl Township Berks County Pa Facebook

The Cost Of Local Government In Philadelphia The Pew Charitable Trusts