is actblue donation tax deductible

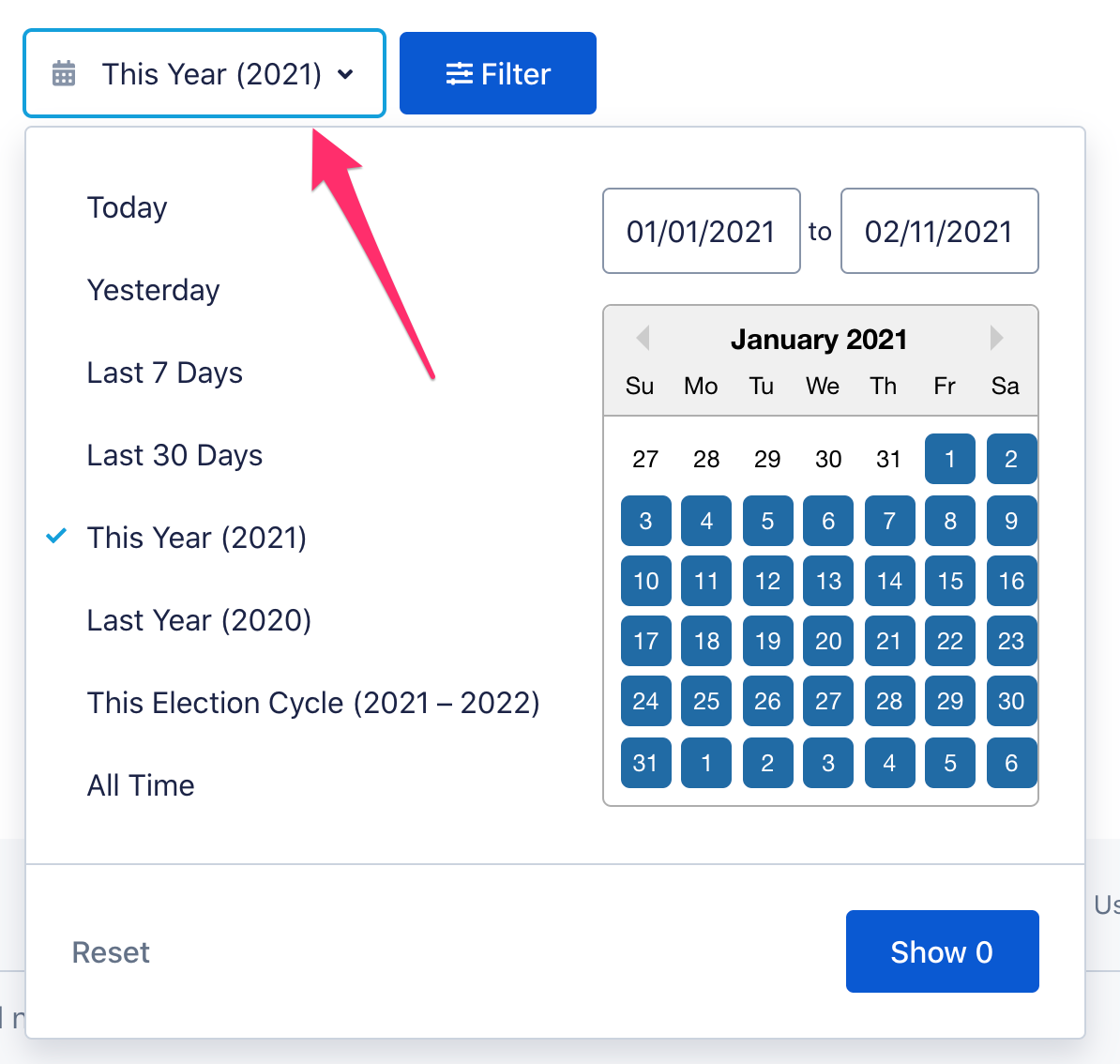

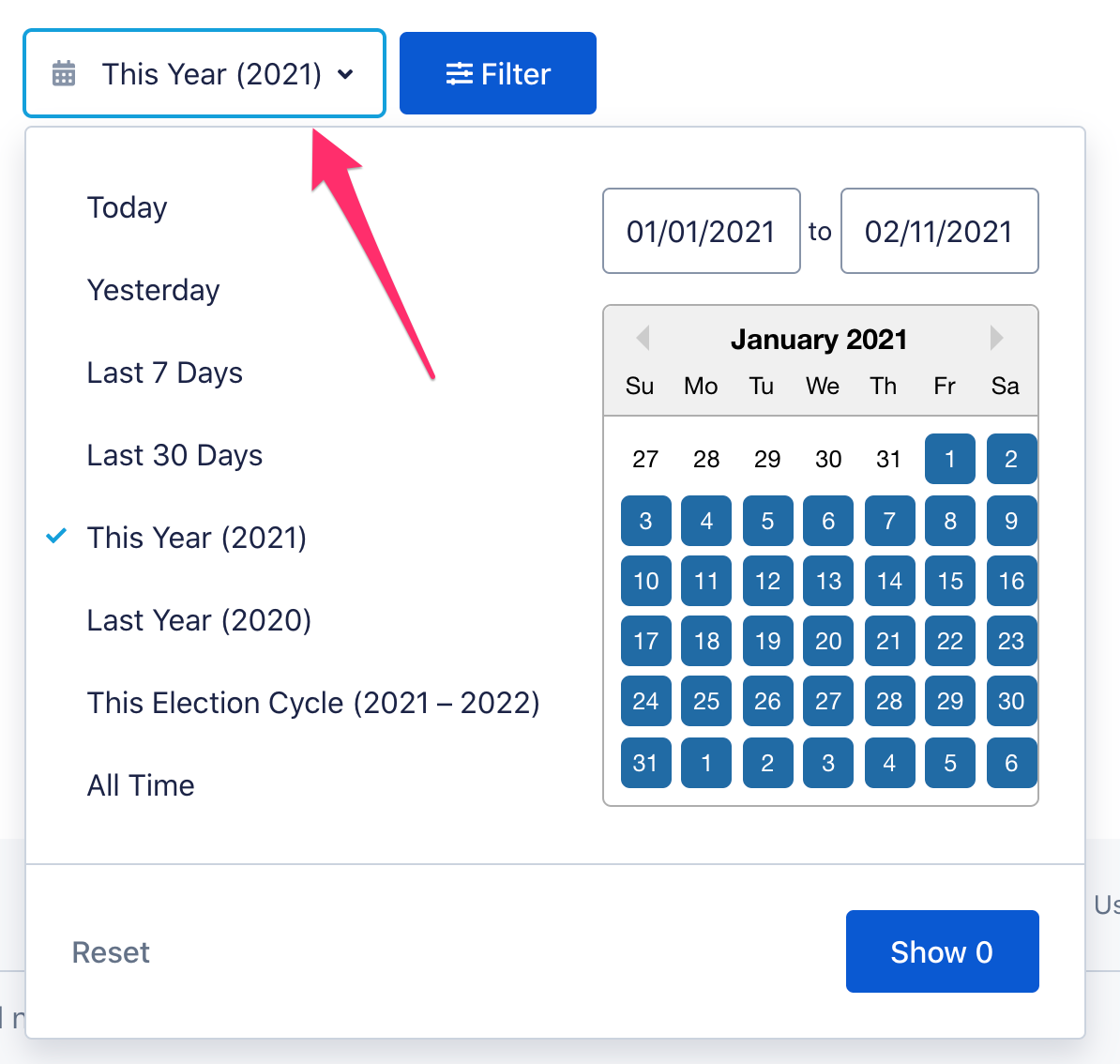

If you have an ActBlue Express account we make it easy for you to find your charitable contributions made through our platform. Contributions must actually be paid in cash or other property before the close of an individuals tax year to be deductible for that tax year whether the individual uses the cash or accrual method.

Why Is There A Disclaimer Box At The Bottom Of The Contribution Form Actblue Support

Donations to this entity dont count as tax deductible but you do become a card-carrying member of the ACLU.

. Tax deduction is given for donations made in the preceding year. To qualify the contribution must be. You do not need to declare the donation amount in your income tax return.

Contributions or gifts to ActBlue are not deductible as charitable contributions for Federal income tax purposes. Contributions or gifts to ActBlue are not deductible as charitable contributions for. Once youre logged in you will immediately see the History page which.

For example if an individual makes a donation in 2021 tax deduction will be allowed in his tax assessment for the Year of Assessment YA 2022. ActBlue is a conduit for donations from individuals across the countrymost of whom arent from Massachusetts. Except that for 2020 you can deduct up to 300 per tax return of qualified cash contributions if you take the standard deduction.

Federal law requires us to use our best efforts to collect and report the name mailing address occupation and name of employer of individuals whose contributions exceed 200 in a calendar year. How ActBlue Is Trying To Turn Small Donations Into A Blue Wave The liberal money-gathering platform is remaking fundraising for. Political Contributions Are Tax Deductible Like.

The same goes for campaign contributions. Drill down to maps showing cities and ZIP Codes. The ACLUs dual structure is not unusual.

To claim a deduction. Classification NTEE Management Technical Assistance Philanthropy Voluntarism and Grantmaking. Some clues are provided by ActBlue a PAC that discloses the address of anyone who uses its online platform.

Select a state for small ActBlue donation totals in 2019 to Virginia. In fact several other high-profile organizations also function as a 501c4 with an affiliated 501c3including the Sierra Club the National Rifle Association NRA and the National Organization for Women. Your gift or donation must be worth 2 or more.

Contributions or gifts to the Democratic National Committee are not tax deductible. ActBlue a platform that funnels donations from individuals to campaigns shows up hundreds of times on Democrats campaign finance filings. Theres just a 395 processing fee on all transactions.

So far this year 37 cents of every 1 in small donations through ActBlue has come from outside Virginia. Previously charitable contributions could only be deducted if taxpayers itemized their deductions. This cash donation will be classified as an above-the-line deduction when individual taxpayers file their taxes in 2021 reducing both AGI and taxable income.

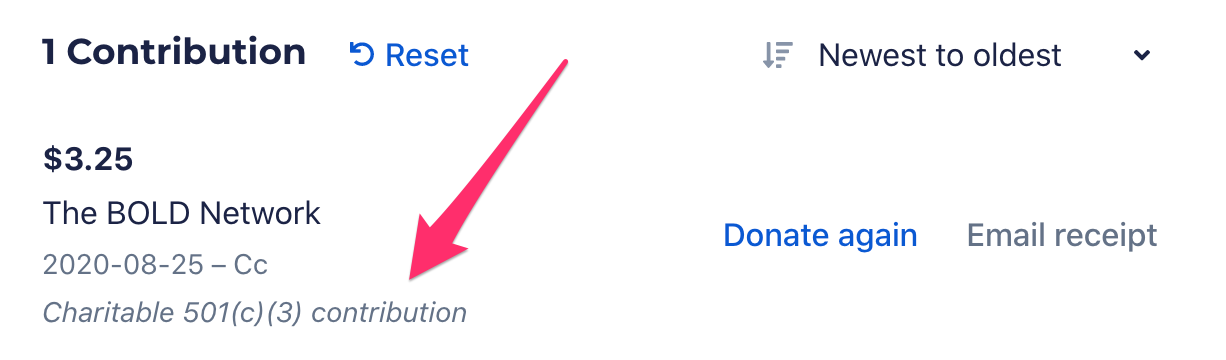

ActBlue Charities is a qualified 501 c 3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law. ActBlue is an American nonprofit technology organization established in June 2004 that enables left-leaning nonprofits Democratic candidates and progressive groups to raise money from individual donors on the Internet by providing them with online fundraising software. 1500 for contributions and gifts to independent candidates and members.

Heres how the CARES Act changes deducting charitable contributions made in 2020. ACTBLUE CIVICS INC is a 501c4 organization with an IRS ruling year of 2013 and donations may or may not be tax-deductible. Paid for by ActBlue Civics.

The answer is no donations to political candidates are not tax deductible on your personal or business tax return. Contributions that exceed that amount can carry over to the next tax year. Claiming Tax Deductible Donations.

At the bottom of the page it clearly states. However taxpayers who dont itemize deductions may take a charitable deduction of up to 300 for cash contributions made in 2020 to qualifying organizations. Will you make a tax-deductible donation today.

This means that people who take the standard deduction which is 12400 for singles and 24800 for married-filing-jointly in 2020. If you made a contribution to a candidate or to a political party campaign or cause you may be wondering if your political contributions are tax deductible. ActBlue Charities is ActBlues funding platform built specifically for 501c3 organizations which can receive tax-deductible contributions.

Is this your nonprofit. ActBlue Charities is a qualified 501c3 tax-exempt organization and donations are tax-deductible to the full extent allowed under the law. Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income.

If the gift is property the property must have been purchased 12 months or more before making the donation. For 2021 this amount is up to 600 per tax return for those filing married filing jointly and 300 for other filing statuses. When you donate on an ActBlue or ActBlue Charities page the donation is earmarked for the group listed on the form Caleb Cade a spokesperson for ActBlue told us in.

SOMERVILLE MA 02144-3132 Tax-exempt since Sept. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Click here to make a donation.

However donations to ActBlue Charities and other registered 501 c 3 organizations are tax deductible. Contributions or gifts made to other organizations through ActBlue Civics are likewise not deductible. In Jones case much of the money she raised via ActBlue came from Texas.

Access the Nonprofit Portal to submit data and download your rating toolkit. As a service it charges a transaction fee of 395 for each donation it receives and passes along to the final recipient. Its stated mission is to empower small-dollar donors.

If an individual donates property other than cash to a qualified organization the individual may generally deduct the fair market value of the property.

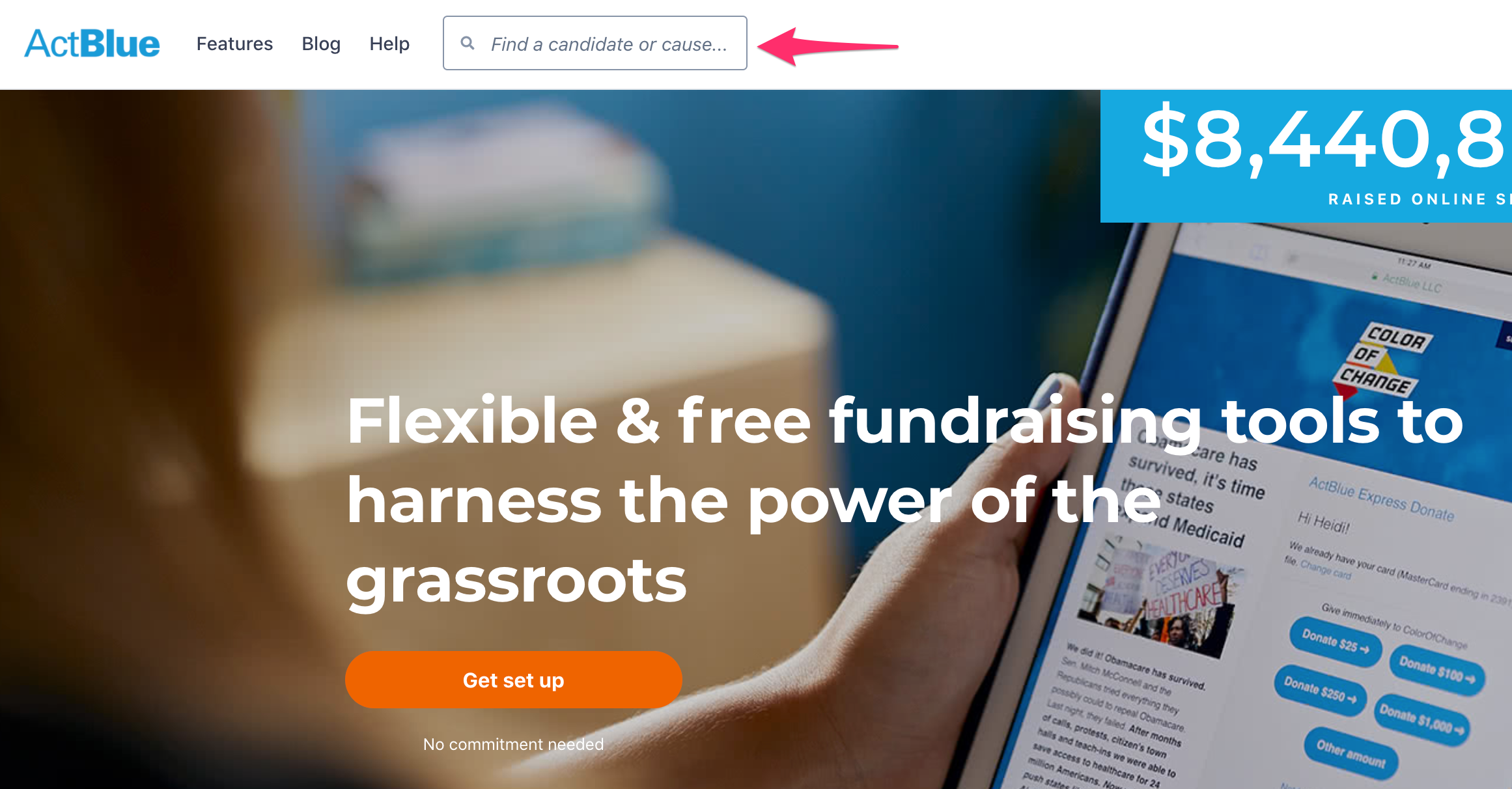

Can I Donate From Your Homepage Actblue Support

![]()

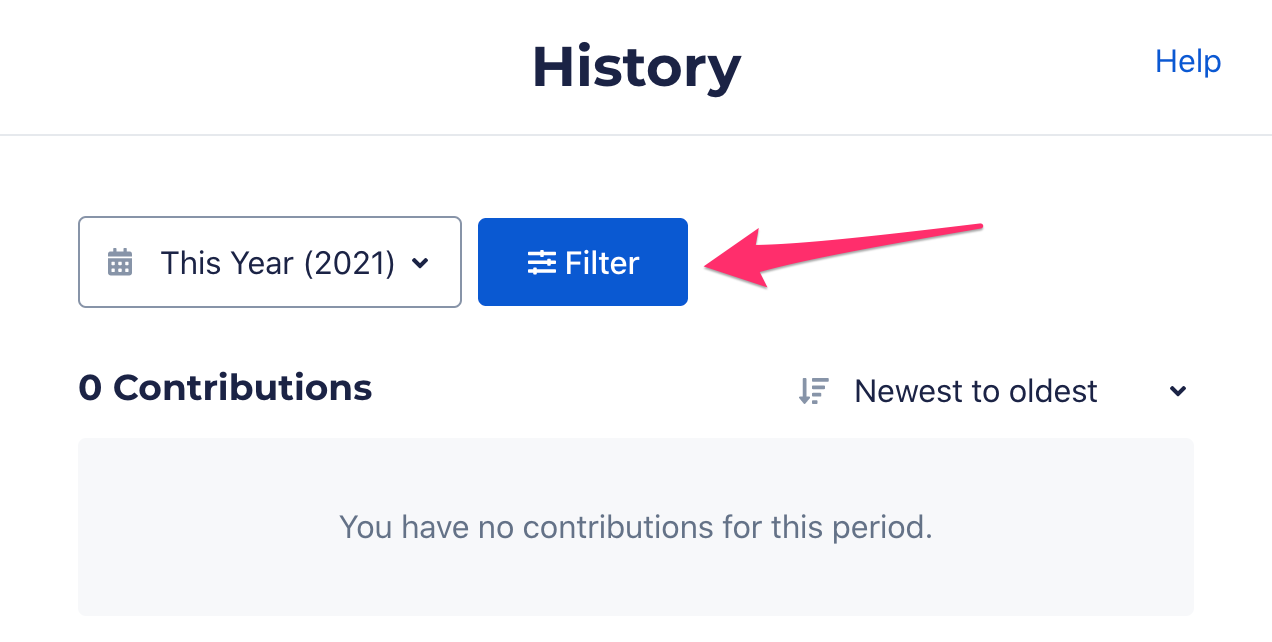

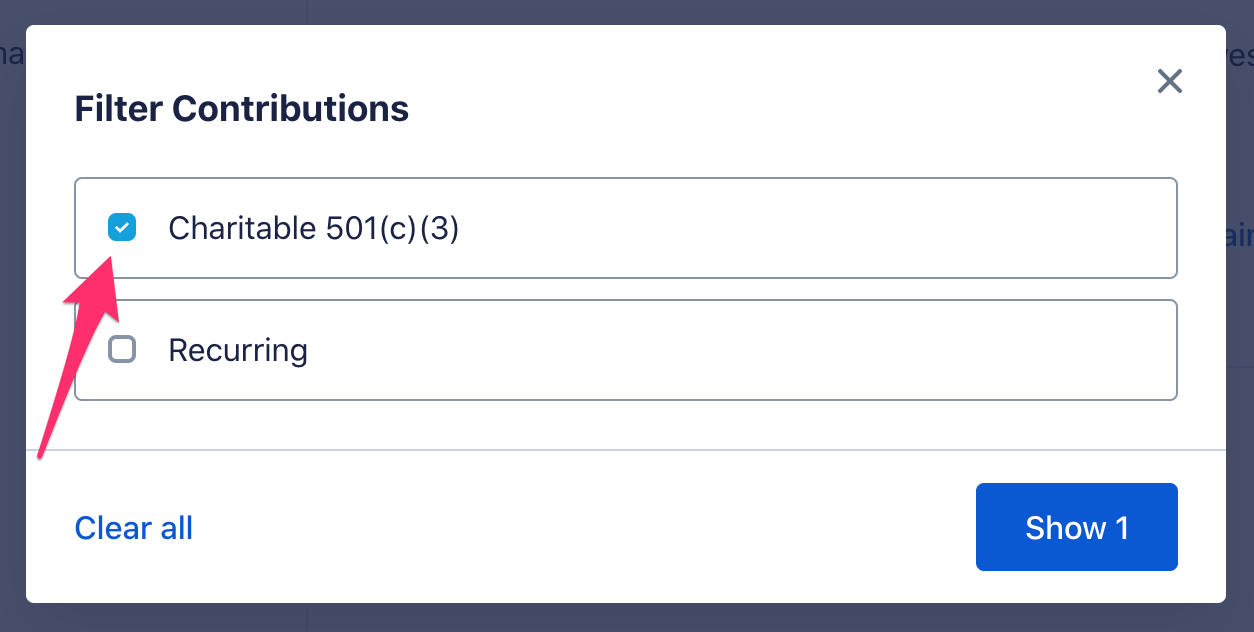

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

I Didn T Mean To Make A Recurring Donation What Do I Do Actblue Support

Pin By Cornelia Hilpert On Usa News Nitbit In 2022 Green Cards Charitable Contributions Candidate

Indivisible Project 2018 Donate Via Actblue Indivisible Movement Supportive

![]()

Are My Donations Tax Deductible Actblue Support

![]()

Are My Donations Tax Deductible Actblue Support

I Don T Remember Adding A Tip To My Contribution Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Are My Donations Tax Deductible Actblue Support

Embeddable Forms Buttons For Nonprofits Actblue Support

Smart Recurring Actblue Support

Are My Donations Tax Deductible Actblue Support